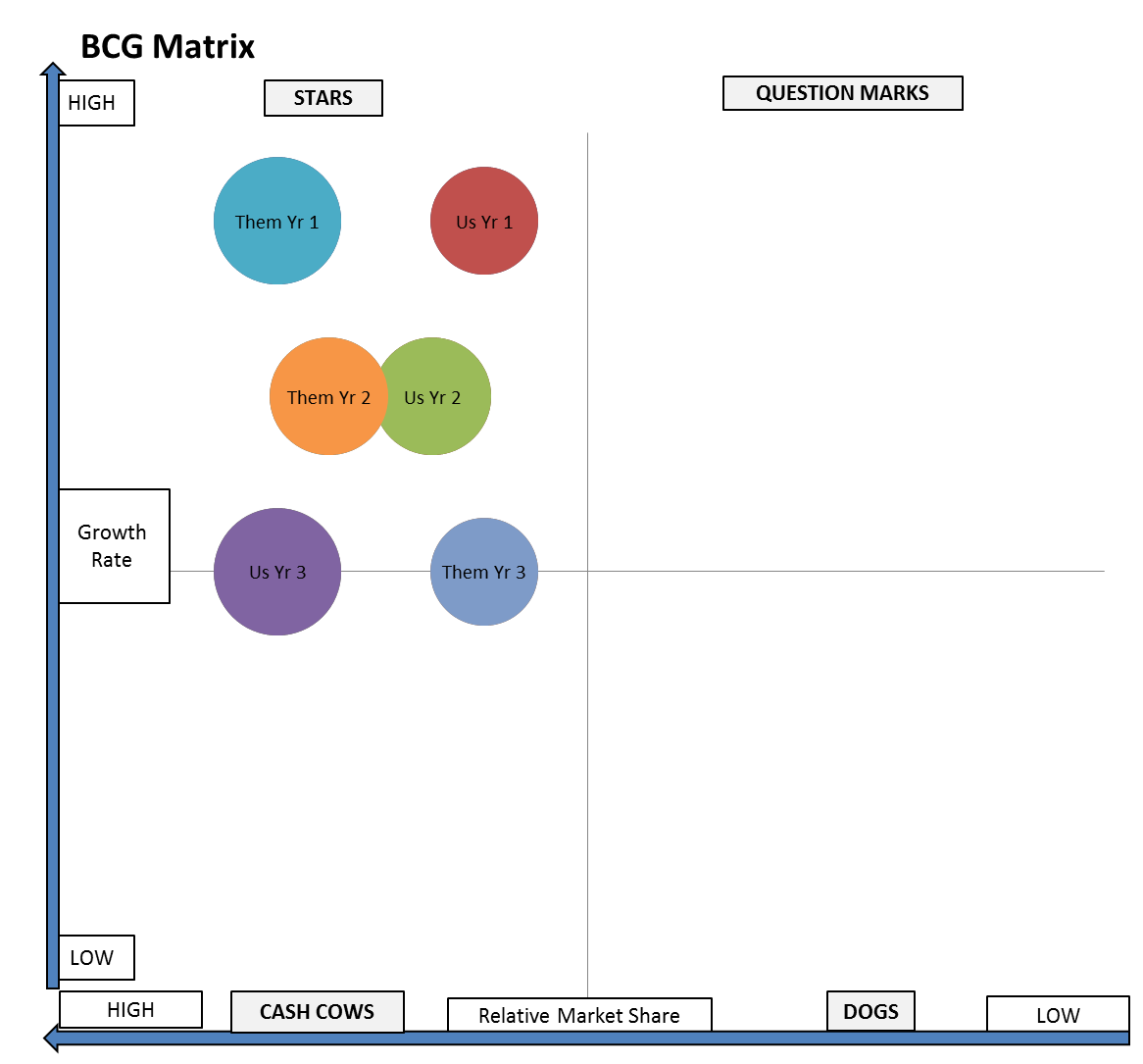

However, if the strategies are successful, a Star can become a cash cow in the long run. Unlike cash cows, Stars cannot be complacent when they are top on because they can immediately be overtaken by another company which capitalizes on the market growth rate. Thus because these two factors are high, the telecom companies are always in competitive mode and they have to juggle between investment and harvesting vis investing money and taking out money time to time. If you look at any top 5 telecom company, the market share is good but the growth rate too is good. Thus, there is a lot of competition in this segment. Stars are products with high market growth rate but low market share.

The best product which comes in mind when thinking of Stars is the telecom products. Let’s discuss the characteristics and strategies of each quadrant in detail for BCG Matrix.Īlso Read Gap Analysis: Types, Advantages, and How to perform Gap Analysis 2) Stars On the basis of this classification, strategies are decided for each SBU / Product.

Cash Cows – High market share but low growth rate (most profitable).

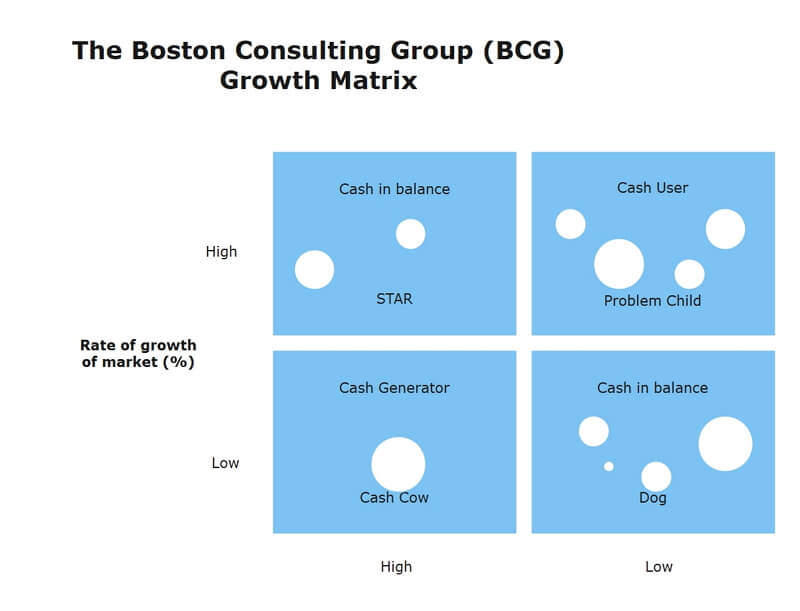

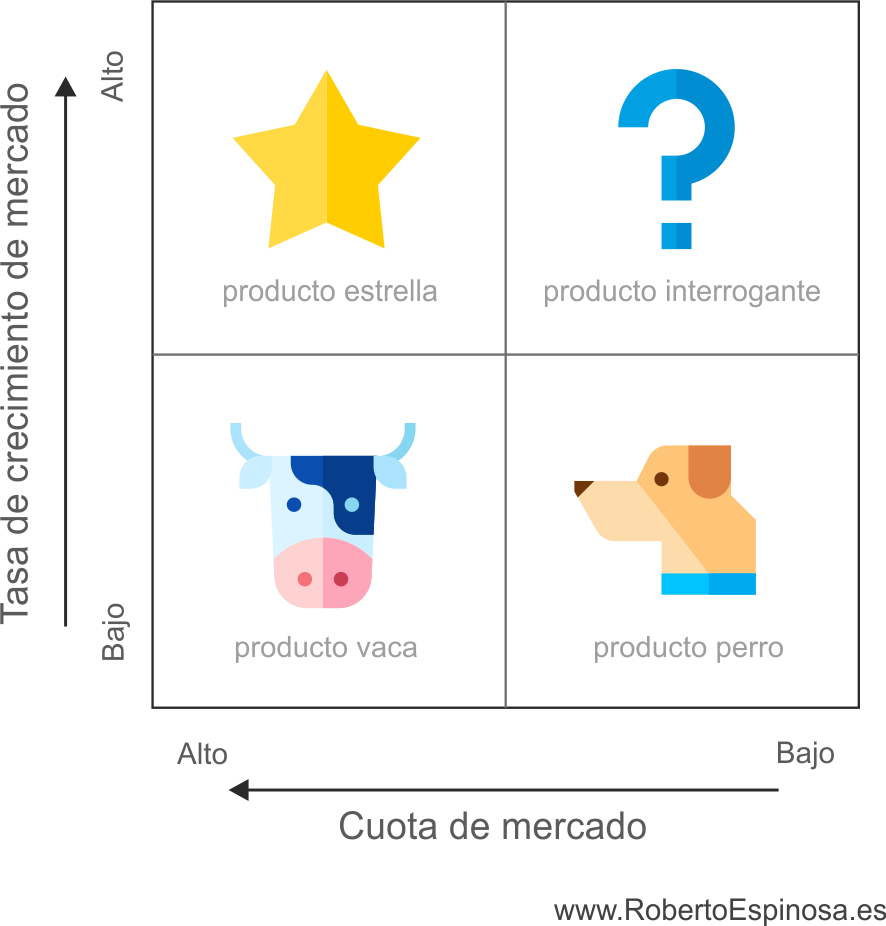

Once the businesses have been classified, they are placed into four different quadrants divided into: Thus when we consider growth rate and market share together, it automatically gives us an overview of the competition and the industry standards as well as an idea of what the future might bring for the product. The market share, on the other hand, comprises of the competition and the product potential in the market. Thus by having 2 basic but at the same time very important factors on X axis and Y axis, the bcg matrix makes sure that the classifications are concrete.Ĭalculating the Market growth rate comprises of both industry growth and product growth rate thereby giving a fair knowledge of where the product / SBU stands in comparison to the Industry. Also Read What is Differentiated Marketing? Steps, Examples & Advantages

0 kommentar(er)

0 kommentar(er)